The Wrong Story: What 354,000 Media Mentions Reveal About Bitcoin in 2025

Here's what the data shows.

Quick heads up - starting with the next edition, our emails will come from a new address: [email protected]

To make sure you keep receiving our intelligence reports, please:

- Add [email protected] to your contacts

- If our next email lands in spam, mark it as "not spam"

Same insights, same quality - just a new return address.

See you in 2026,

Fernando

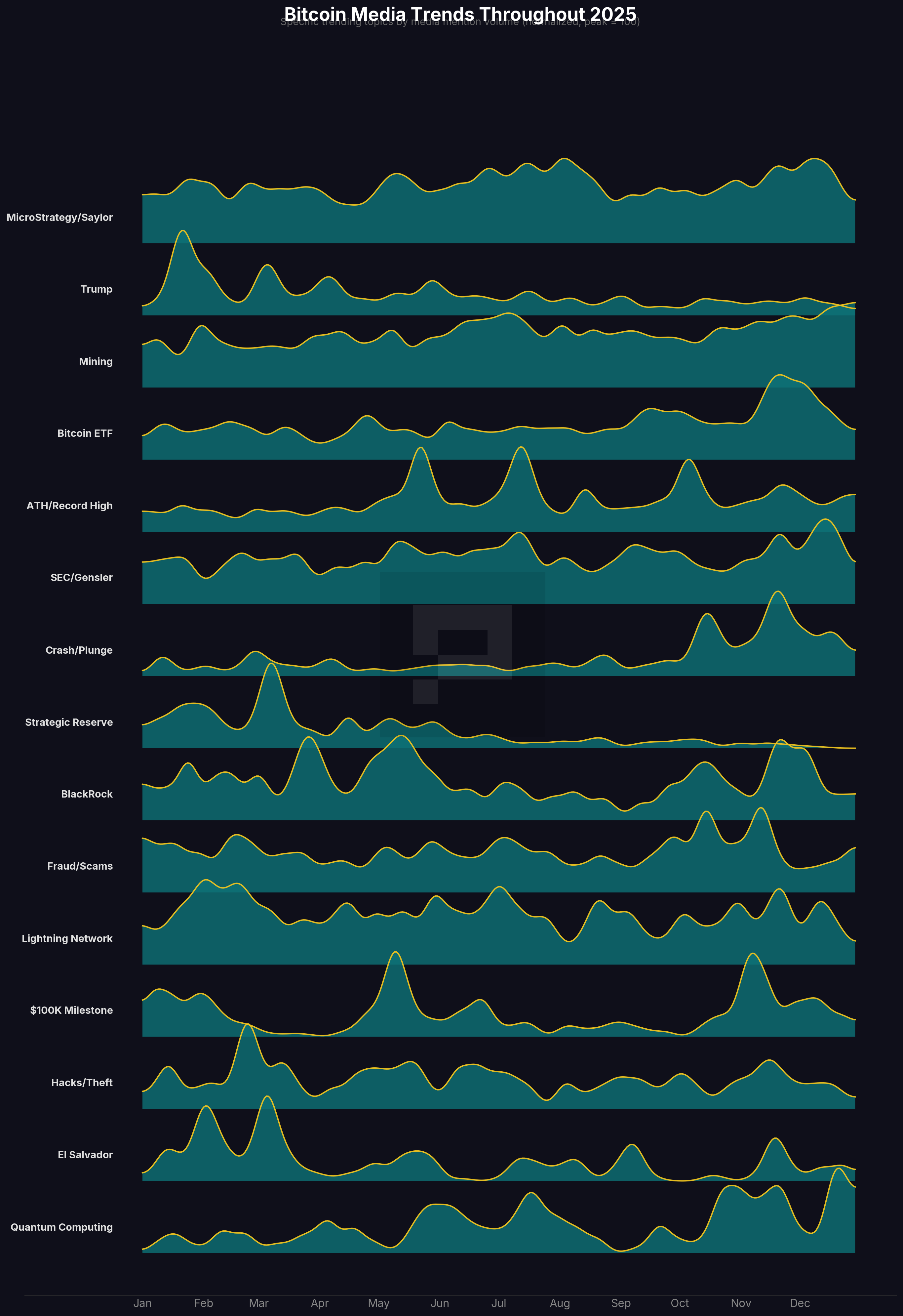

Bitcoin crossed $100K in December 2024 and it hit $126K in October 2025. Those are the numbers everyone remembers.

But price milestones didn't define Bitcoin's media year.

The real story was structural: a regulatory regime change, a policy legitimization, and a technological question that forced the industry to confront its long-term foundations.

Perception tracked 354,000+ media mentions across 407 outlets to map the complete rhythm of Bitcoin coverage. When narratives built momentum, peaked, and faded.

What emerges looks different from the story most outlets told.

January 20: The Regime Change

The SEC/Gensler ridge tells its biggest story immediately.

Gary Gensler departed the SEC on January 20, 2025, the same day as Trump's inauguration. After years of enforcement actions and regulatory uncertainty, the departure marked more than personnel news. It was narrative closure.

The coverage shifted from "what will the SEC do to bitcoin" to "what will bitcoin do without the Gensler era."

The rest of the year stayed relatively quiet on the regulatory front, as Paul Atkins took a more accommodative stance.

March 6: Policy Legitimization

Strategic Reserve spikes in Q1. That's the Executive Order establishing the Strategic Bitcoin Reserve.

Campaign rhetoric became policy. The order designated approximately 207,000 BTC from government seizures as permanent reserve assets. David Sacks, the White House AI and Crypto Czar, called it "a digital Fort Knox."

The Q4 resurgence reflects ongoing legislative efforts to expand the reserve through direct Treasury purchases.

The Administration Effect

Trump coverage builds throughout 2025. But the 2025 Trump narrative differs from 2024's campaign noise.

The coverage centers on policy execution: the Strategic Reserve order, the GENIUS Act enabling stablecoin issuance in July, and a steady stream of pro-crypto appointments.

Notice how Trump and Strategic Reserve coverage move in parallel. The administration made Bitcoin a pillar of its economic messaging.

Strategy: The Consistency Template

MicroStrategy/Saylor shows no dramatic spikes. Just steady, relentless presence throughout the year.

Regular Bitcoin purchases, publicly announced, kept the company perpetually in the news cycle. While flashier narratives burned out, Strategy maintained the background hum of institutional conviction.

The consistency itself is the story. And it offers a template worth studying.

October 6: The Actual Peak

ATH/Record High spikes in Q4 as Bitcoin reached $126,210 on October 6, 2025.

The $100K Milestone ridge shows activity throughout the year as Bitcoin repeatedly crossed and recrossed that threshold.

The current price sits well below October's peak, explaining the Crash/Plunge coverage spike in December.

ETF Year Two

Bitcoin ETF coverage could have faded after the January 2024 launch hype. It didn't.

Throughout 2025, ETF attention stayed elevated. Record inflows, international approvals, and ongoing comparisons to traditional benchmarks kept the story alive. BlackRock's IBIT became one of the most successful ETF launches in history.

The Quantum Surprise

Quantum Computing spikes dramatically in October.

This corresponds to Google's Willow chip breakthrough, which ran 13,000x faster than classical simulation for certain physics algorithms. Combined with May 2025 research showing a 20-fold reduction in qubits needed to crack RSA encryption, quantum threats became a serious discussion.

Some experts still estimate meaningful threats are years away but on social media other profiles added urgency. This urgency was largely ignored by outlets outside the crypto media.

But 2025 was the year the Bitcoin community started taking cryptographic upgrades seriously. BIP360, proposing quantum-safe signatures, emerged from these conversations.

The Quiet Signals

Absences reveal as much as peaks.

Lightning Network shows minimal mainstream coverage despite ongoing technical development. The protocol progress happened. The media didn't notice. Developer communities and mainstream coverage remain disconnected.

El Salvador maintains flat, low-level presence. News in 2021. Routine by 2025.

Hacks/Theft and Fraud/Scams persist throughout the year but never dominate. Background noise rather than defining narratives. The existential "Bitcoin enables crime" framing has faded from mainstream coverage.

What 2025 Actually Revealed

January: Regulatory regime change. March: Policy legitimization. October: Price validation followed by correction. Year-end: Technical questions about long-term cryptographic foundations.

For the first time, Bitcoin's biggest media moments weren't about whether it would survive. They were about how permanent it's becoming, and whether its infrastructure can handle that permanence.

The $100K headline was easy to write. The structural shift underneath it is what matters for 2026 planning.

Three Patterns Worth Watching

1. Policy narrative has runway, but saturation approaches. Strategic Reserve coverage is still building. Teams leveraging this angle have a window. Our data suggests 2-3 months before fatigue sets in and the narrative needs refreshing.

2. The "existential threat" frame is retired. Major outlets stopped running "Bitcoin is dead" coverage in 2025. That narrative exhausted itself. What replaces it during the next downturn will define the next cycle's media landscape.

3. External tech creates unpredictable narrative injection. The quantum spike came with near-zero warning. Whatever the next external trigger is (AI regulation, energy policy shifts, banking system stress), it will arrive the same way.

Analysis based on 354,360 media mentions across 407 outlets, January 1 through December 29, 2025.

Perception tracks emerging narrative patterns across 650+ sources, detecting trend shifts before they reach mainstream coverage. The methodology behind this analysis, and real-time alerting for patterns like these, is available to subscribers.